Southeast Asia Auto Finance Market to Grow at 3.33% CAGR (2019-2024) Amid Digital Shift & Evolving Consumer Trends

Southeast Asia's auto finance market grows at 3.33% CAGR, fueled by digital trends, rising vehicle demand, and regulatory shifts shaping the industry.

Why This Growth Rate Requires Attention?

Household Debt & Interest Rates Restrain Growth -

Several Southeast Asian nations, including Thailand and Malaysia, face high household debt, limiting borrowing. Thailand's debt-to-GDP exceeded 90% in 2023, while rising rates in Indonesia and the Philippines tightened credit.

Uneven Vehicle Sales & Market Volatility -

While the Philippines saw record sales (429,807 units in 2023), Thailand’s production is set to drop from 1.9M to 1.7M in 2024. Vietnam’s auto finance sector shrank 19.46% YoY in 2022, reflecting economic pressures.

Slow Digital Adoption in Auto Loans -

Although the region is undergoing a digital transformation, the pace of adoption remains inconsistent. While Indonesia and Vietnam are embracing Buy Now, Pay Later (BNPL) solutions, traditional bank-led financing continues to dominate in Malaysia and Thailand, slowing the shift to fintech-driven auto loan models. This fragmented digital transformation is limiting the industry’s overall expansion.

Regulatory Tightening Limits Flexibility -

Governments across Southeast Asia are introducing stricter regulations on BNPL services and digital lending to prevent consumer over-indebtedness. New compliance guidelines for auto loans in Indonesia and the Philippines are adding scrutiny to loan approvals, potentially slowing market penetration.

Navigating a Sub-5% CAGR Growth Path -

Despite structural hurdles, opportunities lie in expanding digital financing, improving affordability, and integrating BNPL and EV financing models. Makreo Research’s latest report, “Southeast Asia Auto Finance Market Size and Forecast (2019-2030),” provides critical insights into market trends, challenges, and growth strategies.

Country-Specific Insights on the SEA Auto Finance Market:

Malaysia Auto Finance Market -

The automotive sector contributes 4% to Malaysia’s GDP, with the National Automotive Policy (NAP2020) aiming to elevate this to 10% by 2030. The expanding middle class, which makes up about 40% of the population, is a key driver of auto financing growth.

Thailand Car Loan Trends -

As Southeast Asia’s largest automotive producer, Thailand experienced auto finance market growth in 2022-2023, followed by a decline in 2024. High household debt and a shift toward electric vehicles (EVs) are reshaping the industry. Stakeholders are urging government incentives to support both internal combustion engine (ICE) and hybrid vehicle production.

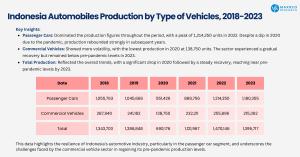

Indonesia Vehicle Finance Market -

With a large youth population, Indonesia presents a high-growth market for auto loans. In 2023, Hyundai Capital Services Inc. partnered with Shinhan Bank and Sinar Mas Group to enter Indonesia’s credit finance sector, signaling confidence in long-term market potential.

Philippines Auto Loan Market -

Despite rising inflation and high interest rates in 2023, the Philippines auto finance sector remained robust, with record-breaking motor vehicle sales (430,000 units) and a total auto loan portfolio registering 20-22% annual growth.

Singapore Car Finance Growth -

Singapore’s car ownership rate declined from 40% in 2013 to about one-third in 2023. Despite this, strong financial infrastructure supports the auto finance industry, with the Monetary Authority of Singapore (MAS) enforcing stringent loan regulations.

Vietnam Auto Financing Sector -

Vietnam’s car ownership reached 63 vehicles per 1,000 people in 2023. However, the country’s auto finance market contracted by 19.46% YoY in 2022, reflecting economic challenges and declining vehicle sales.

Recent Developments in Auto Finance Companies:

Public Bank & PRO-NET Collaboration: Public Bank teamed up with PRO-NET to provide financing for smart energy vehicles, enabling seamless online hire purchase via the Smart Customer App.

Krungsri Auto Broker & Chubb Life Thailand: Their 21-year partnership extends until 2025, focusing on an online platform to enhance access to insurance products.

TMB Thana Chart Bank’s Digital Push: In 2024, the bank will launch MyCredit, a digital loan widget, while enhancing digital channels for car hire purchase loans.

PT BFI Finance’s Bond Issuance: In Sept 2024, PT BFI Finance plans to issue Bond VI Phase I (IDR 600B) to strengthen its financial position.

Southeast Asia Auto Finance Market Growth Outlook:

The Southeast Asia vehicle financing sector is shifting, especially in two-wheelers. In 2023, around 12.72M motorcycles and scooters were sold, but early 2024 saw an 11.5% decline in key markets like Vietnam, posing short-term challenges. Despite this, the 2025-2029 forecast projects a steady single-digit CAGR, signaling recovery driven by evolving auto finance trends and greater accessibility to vehicle financing in SEA.

Comprehensive Study by Makreo Research:

Makreo Research’s report, Southeast Asia Auto Finance Market Size and Forecast (2019-2030), provides an extensive analysis of the region’s auto finance landscape. The study covers key market dynamics, historical and current market performance, and the regulatory environment across Malaysia, Thailand, Indonesia, the Philippines, Singapore, and Vietnam.

The report offers in-depth segmentation across multiple parameters, including vehicle types, lender types, loan tenure, and fuel categories. Additionally, it profiles leading market players such as Public Bank Group, Krungsri Bank, TMB Thana Chart Bank, PT BFI Finance, Security Bank, and Robinsons Bank, detailing their strategic initiatives and financial performance.

This extensive study serves as a valuable resource for industry professionals, equipping them with insights to navigate the evolving auto finance market in Southeast Asia and make well-informed business decisions.

Study Period:

2019-2024 - Past and Present Scenario

2024 - Base Year

2025-2030 - Future Outlook of the industry

Key Market Segments:

Lender Type:

• Banks

• NBFC

• Captive Finance

• Credit Unions

Type of Vehicle Financed:

• Passenger Vehicles

• Commercial Vehicles

• Two-Wheelers

• Electric Vehicles

Geographical Location:

• Urban Markets

• Semi-Urban Markets

• Rural Markets

Market Players Covered:

• Public Bank Group

• Krungsri Bank

• TMB Thana Chart Bank

• PT BFI Finance

• Mandiri Tunas Finance

• BDO Unibank Philippines

• Philippines National Bank

• Security Bank

• Maybank Singapore Limited

• OCBC Bank Limited

• Vietcom Bank

• BIDV

Saurabh Adsule

Makreo Research and Consulting

+91 96196 99069

email us here

Visit us on social media:

X

LinkedIn

Distribution channels: Automotive Industry, Banking, Finance & Investment Industry, Business & Economy, Manufacturing, Retail

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release