ATN’s CEO Mark Gilbert Discusses September 2024 U.S. Auto Sales Report and Provides Industry Forecasts

September Sales Decline: A Temporary Setback?

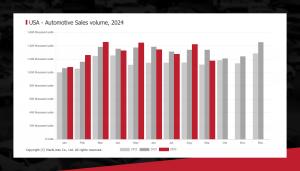

"While the 12.3% drop in September is concerning, we need to look at the bigger picture," said Gilbert. "The automotive market remains resilient, even in the face of economic and environmental challenges. Factors such as the two fewer business days compared to last year and the catastrophic impact of Hurricane Helene in key Southern regions have contributed to the decline. However, we should not let this short-term disruption overshadow the industry's long-term trajectory."

Gilbert pointed out that light trucks, which represent the bulk of U.S. auto sales, saw a 10.9% decrease, while passenger cars experienced an even sharper decline of 18.0%. "The light truck segment remains the industry's backbone, and while the September dip is notable, I expect a recovery in the coming months as inventories stabilize, especially in the SUV and pickup markets," he added.

Inventory and Pricing Challenges

The report highlighted that total inventory in September grew by 40% year-over-year to 2.8 million vehicles. However, Gilbert emphasized that inventory levels alone don't tell the whole story. "While inventories have improved, elevated pricing and tighter credit conditions continue to limit consumer access," he explained. "Financing has become more difficult, especially for those purchasing higher-end or electric vehicles, where interest rates have increased the cost of ownership."

According to Gilbert, brands such as Toyota, Honda, and Subaru continue to manage tight inventories, while Stellantis and Ford have seen excess inventories. "This disparity highlights the need for automakers to rethink their pricing strategies and focus on more accessible models for consumers. Electric vehicles and hybrids are a growing segment, but they come with a price tag that many find hard to justify amid rising loan rates."

Forecasts and Growth Opportunities: Electric and Hybrid Vehicles

Despite the decline in vehicle sales, Gilbert sees significant growth opportunities in the electric vehicle (EV) and hybrid segments. "We're seeing automakers like Hyundai and Kia report double-digit increases in EV and hybrid sales. Kia’s 43% increase in EV sales, driven by their new EV9 mid-size electric SUV, is a strong indicator of where the market is headed," said Gilbert. "Consumers are increasingly looking for fuel efficiency and eco-friendly options, especially as gas prices remain volatile."

Gilbert also noted Tesla's 9.1% year-over-year growth, the brand's first increase since February, as a sign of recovery in the EV sector. "Tesla remains a leader in the EV space, and their rebound in September is a positive sign for the industry. As more models hit the market from other automakers, competition will only intensify, ultimately benefiting consumers with more choices and better pricing."

Looking Ahead: A Return to Stability?

Gilbert remained cautiously optimistic when asked about his forecasts for the rest of 2024. "The auto market is entering a stabilization phase. Inventory levels are improving, and as manufacturers adjust to consumer demand for more affordable, hybrid, and electric models, I expect sales to pick up gradually. However, much will depend on the broader economic conditions, particularly interest rates and consumer confidence."

Mark Gilbert remains confident in the automotive industry's resilience. "We're in a transformative period. The market will face challenges, but automakers will find themselves well-positioned for long-term growth with the right strategies, particularly around EVs, hybrids, and consumer financing."

Mark Gilbert

ATN

+1 480-999-5055

email us here

Distribution channels: Automotive Industry, Banking, Finance & Investment Industry, Business & Economy, Companies, Energy Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release