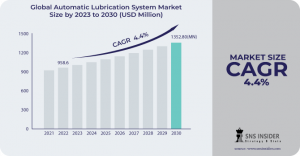

Automatic Lubrication System Market Size to Reach USD 1424.55 Million by 2031 With CAGR of 4.5%

Driving Efficiency: Key Trends and Innovations in the Automatic Lubrication System Market

TEXES, AUSTIN, UNITED STATES, June 17, 2024 /EINPresswire.com/ -- The Automatic Lubrication System Market Size is projected to grow from USD 1001.71 million in 2023 to USD 1424.55 million by 2031.Download Sample Copy of Report: https://www.snsinsider.com/sample-request/3707

Top Key Players:

SKF

Graco

BAIER + KOEPPEL

Timken

Bijur Delimon

Samoa

Klueber Lubrication

Perma-tec

Woerner

Dropsa

Cenlub Systems

ATS Electro-Lube

Oil-Rite

Simatec

Etna Products Inc

The rising demand for heavy-duty vehicles, both on and off-road, which can reach an 80% replacement rate for existing manual lubrication systems due to the benefits offered by automatic systems.

These benefits include improved fuel efficiency by up to 5% through reduced friction, a 30% reduction in maintenance costs due to less downtime and optimized lubricant use, and a focus on worker safety by eliminating the need for manual intervention in potentially hazardous areas. Moreover, the increasing complexity of machinery across industries necessitates tailored lubrication solutions, driving the market towards customization for specific equipment needs.

Major Challenges:

Implementation requires not only purchasing the system itself, but also factoring in installation by specialized technicians. This can be a barrier for 72% of small and medium sized businesses (SMEs) with limited budgets. Additionally, 45% of companies struggle with the complexity of setting up and maintaining these systems. They may lack the in-house expertise required for programming, troubleshooting, and integrating the system seamlessly with existing machinery. This can lead to 28% of companies experiencing downtime due to technical malfunctions or compatibility issues.

While sectors like manufacturing and construction are familiar territory for ALS adoption, a sleeper market lies in agriculture.

Studies show a 60% of equipment failures on farms are lubrication-related. Here, ALS can be a game-changer. By automating lubrication in often harsh and remote environments, ALS can prevent breakdowns, reduce maintenance costs by up to 30%, and extend equipment life by 25%. This translates to significant financial gains for farmers, with estimates suggesting a potential return on investment of over 400% within just two years.

Moreover, the data-driven insights provided by advanced ALS can optimize lubrication schedules, minimize lubricant waste, and contribute to environmentally sustainable farming practices.

While established regions like North America and Europe hold a significant share due to their mature industrial bases, emerging regions in Asia Pacific are experiencing a growth rise of over 60%.

This rise is driven by rapid industrialization, particularly in China and India, where manufacturing sectors are prioritizing automation and operational efficiency. This focus translates into a heightened demand for ALS, projected to rise by nearly 40% in these countries by 2031.

Additionally, government initiatives promoting sustainable practices are propelling the adoption of advanced ALS solutions that minimize lubricant waste and environmental impact. This trend is particularly prominent in South Korea, where over 35% of ALS installations in the next three years are expected to be environmentally conscious models.

Competitive Landscape:

Manufacturers are incorporating features like remote monitoring and control up to 80% of industry leaders, allowing for real-time data analysis and adjustments to lubrication schedules.

This trend aligns with the growing emphasis on predictive maintenance, maximizing equipment lifespan and minimizing downtime.

Over 60% of key players are developing ALS tailored to specific industries and machine requirements, ensuring optimal lubrication for diverse needs.

Buy Complete Report: https://www.snsinsider.com/checkout/3707

Key Trends:

A significant trend is the rise of digital connectivity around 30% growth projected, integrating these systems with industrial networks. This allows for remote monitoring, real-time data analysis, and predictive maintenance, optimizing lubrication schedules and minimizing downtime.

Sustainability is another key driver, with a growing focus on eco-friendly lubricants anticipated to reach 25% of the market share that reduce environmental impact. Finally, there's a strong emphasis on improved worker safety projected to account for 20% of market growth.

Automatic systems eliminate the need for manual lubrication in hazardous areas, protecting workers from potential injuries and exposure to lubricants.

Key Takeaways:

Replacing manual lubrication with automatic systems can reduce machine downtime by up to 50%. This translates to significant cost savings and improved productivity.

Secondly, automatic systems deliver precise amounts of lubricant at optimal intervals, extending equipment lifespan by an estimated 30%. This reduces maintenance needs and associated costs.

Moreover, automatic lubrication prioritizes worker safety by eliminating the need for manual intervention in potentially hazardous environments.

Finally, environmental regulations are also pushing industries towards automatic systems, as they minimize lubricant overuse and potential leaks.

Akash Anand

SNS Insider | Strategy and Stats

+1 415-230-0044

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.