Daily Top 5 Daily Top 5 |

Sebi nod for Awfis IPO; Byju's NCLT saga continues

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Daily Top 5

We'll soon meet in your inbox.

The stock market regulator has greenlit coworking startup Awfis’ IPO plans. Details on this and more in today’s ETtech Top 5.

Also in this letter:

■ ET Explainer: What is VASA-1?

■ Razorpay’s foray in UPI infrastructure

■ Mamaearth shares rally 8%

Office-sharing startup Awfis Space Solutions has received Securities and Exchange Board of India’s clearance for an initial public offering (IPO).

IPO details: The Delhi-based company had filed its draft IPO papers in December, proposing to raise Rs 160 crore through an issue of fresh shares, along with a sale of 10 million shares by its existing shareholders.

The company plans to utilise the net proceeds from the fresh issue of shares for expansion and establishing new centres, working capital requirements and general corporate purposes.

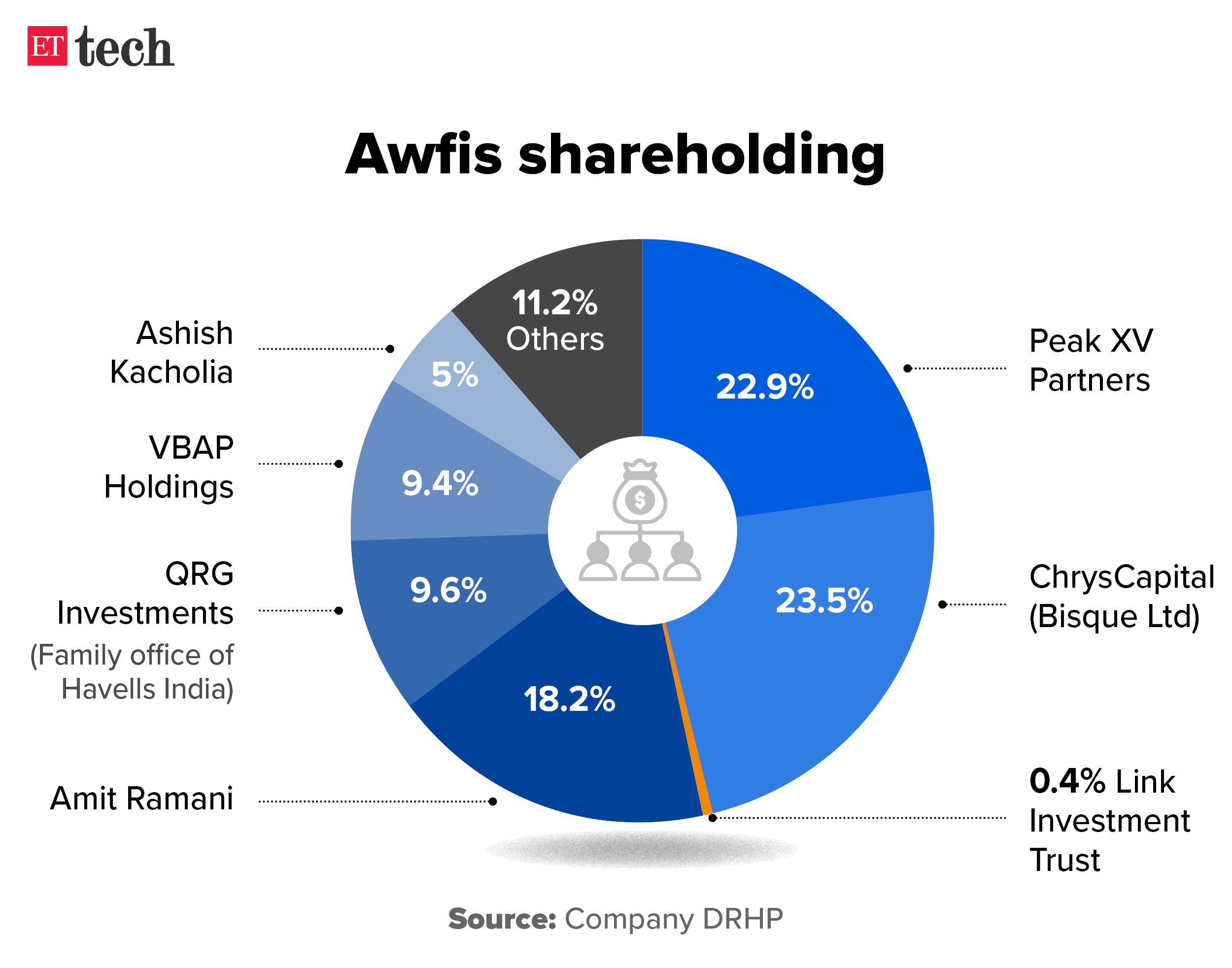

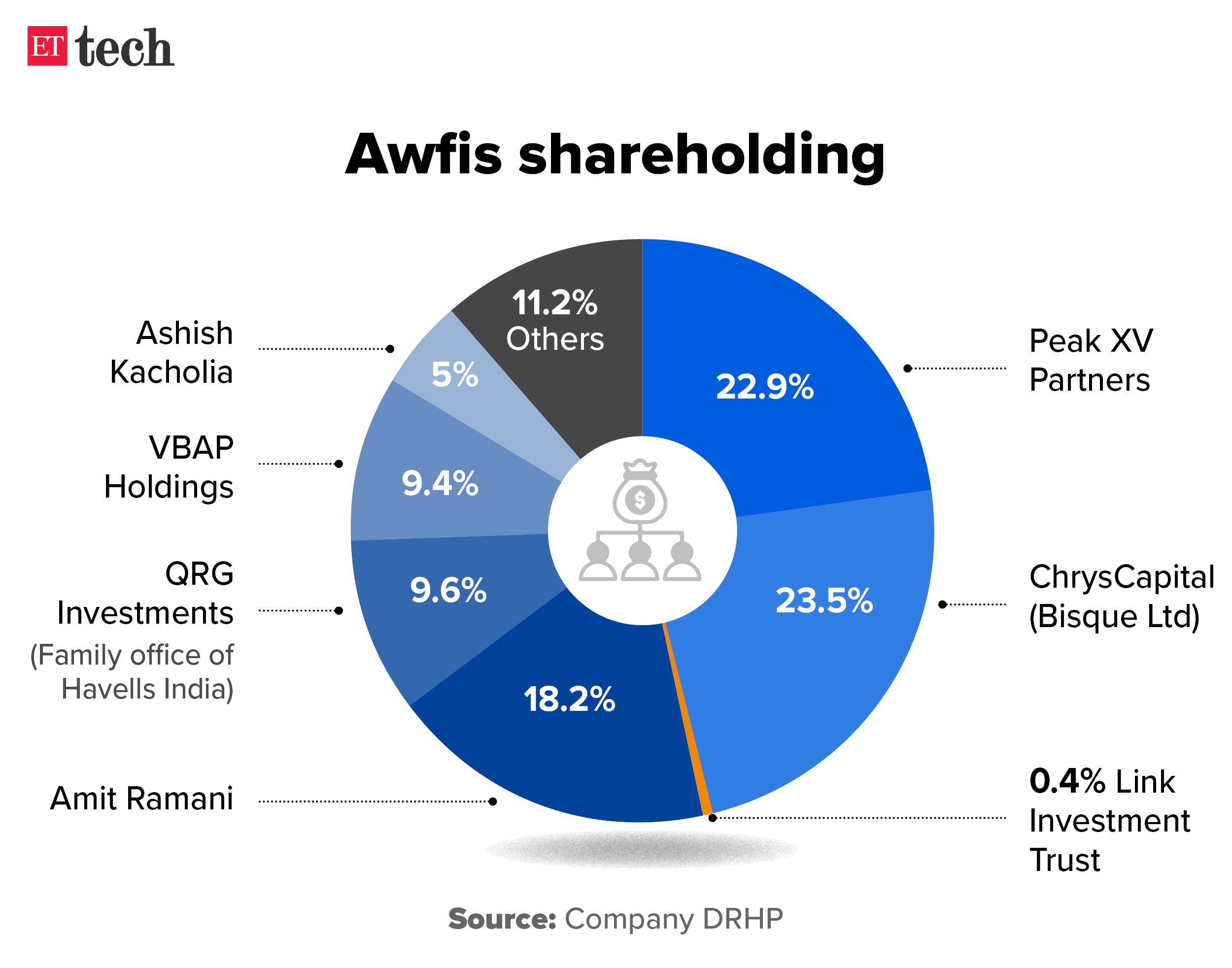

Who’s selling: Peak XV Partners plans to sell about 5 million shares in Awfis through the proposed IPO. Bisque Ltd, a unit of private equity firm ChrysCapital, is also looking to sell nearly as many shares, while real estate investment trust Link Investment Trust is seeking to sell over 75,000 shares.

In its last fundraising round in 2022, Awfis was valued at around $110 million (Rs 917 crore at current exchange rates).

FY23 numbers: In the fiscal year ended March 31, 2023, Awfis’ operating revenue more than doubled to Rs 545 crore from Rs 257 crore in FY22, as per its draft red herring prospectus. For the first quarter of fiscal 2024, Awfis reported operating revenue of Rs 188 crore.

Upcoming IPOs: Several new-age companies, including SoftBank-backed Unicommerce, electric vehicle maker Ola Electric, omnichannel retailer FirstCry, and fintech firm Mobikwik have filed draft IPO papers with Sebi. Bengaluru-based food and grocery-delivery firm Swiggy is also planning to file soon for a $1 billion IPO.

Also read | WeWork to sell 27% stake in India unit via Rs 1,200 crore secondary deal

Byju Raveendran, founder, Byju's

Byju Raveendran, founder, Byju's

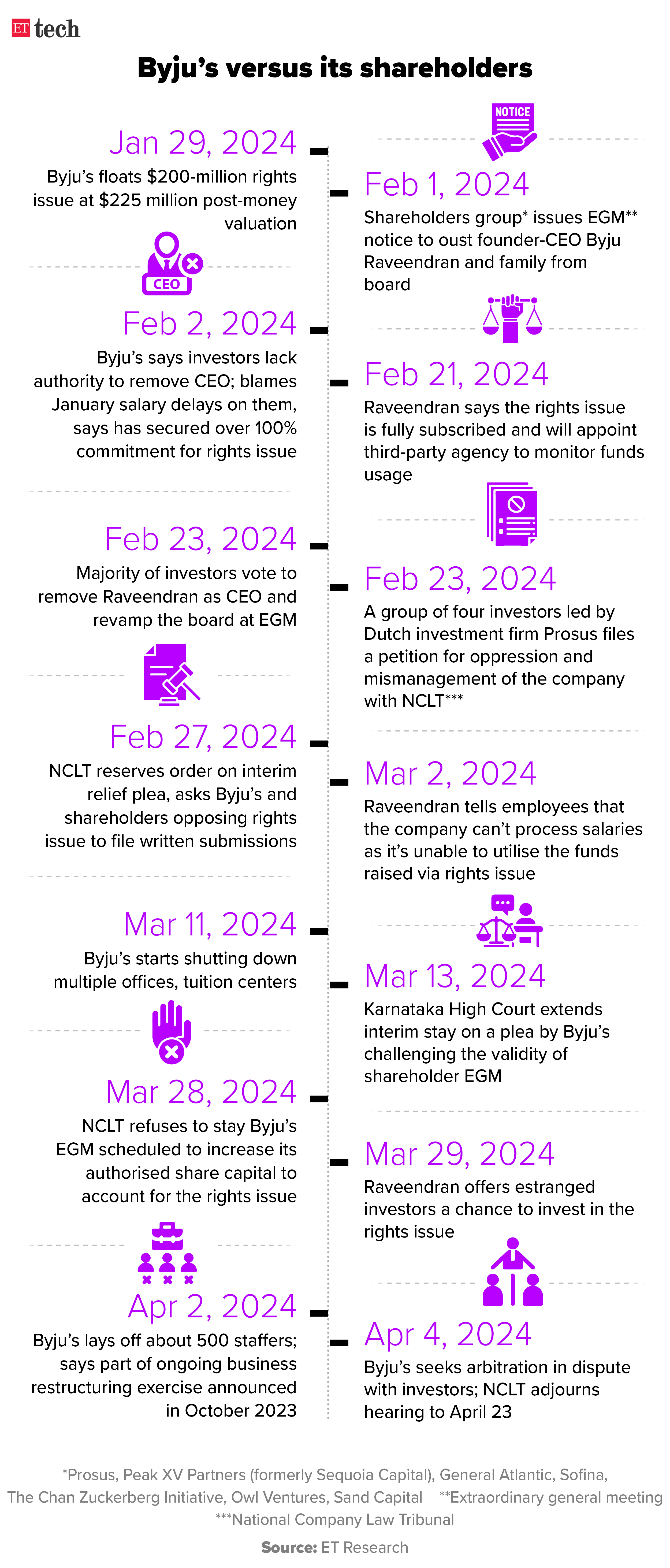

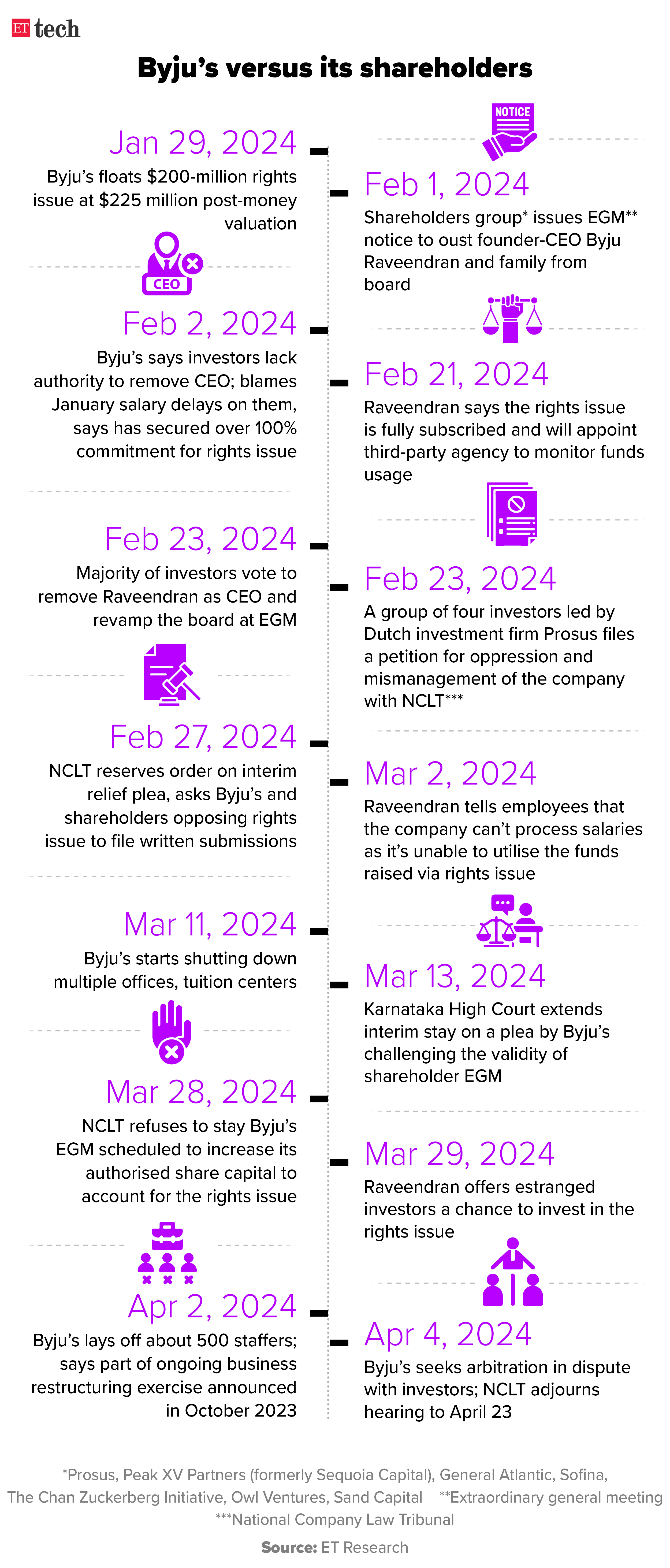

The National Company Law Tribunal (NCLT), Bengaluru, on Tuesday heard the latest arguments in the Byju’s versus investors saga and adjourned the matter for hearing on June 6.

What happened today? The arguments began with a senior counsel on the investors’ side alleging a violation on the part of Byju’s with respect to an NCLT order dated February 27, which prevented the Bengaluru-based firm from allotting shares to investors as part of the disputed rights issue without procedurally increasing authorised share capital.

The tribunal had also directed Byju's to keep the proceeds from the $200 million rights issue in a separate escrow account. But Byju’s did not do this, and instead used the funds, the investors’ counsel alleged.

Byju’s stance: Byju’s counsel contended that its actions were performed in accordance with the law and did not violate the order as per its interpretation of the same.

A group of Byju’s investors led by Dutch investor Prosus is seeking to block a $200 million rights issue and the removal of founder Byju Raveendran as CEO of the edtech firm.

Zoom out: Byju’s, facing a severe cash crunch, paid only a part of March salaries to its employees, as of April 20, in yet another delay of these payouts. Earlier in the month, the startup laid off about 500 staffers, largely across sales and marketing functions.

Also read | Byju's seeks arbitration in dispute with investors; NCLT adjourns hearing to April 23

Technology major Microsoft last week introduced a new image-to-video model called VASA-1 that it developed as a research project. Here’s a breakdown on what it’s all about:

What does the VASA-1 do? Microsoft described VASA-1 as an AI model that produces ‘lifelike audio-driven talking faces in real time’. ‘VAS’ stands for visual affective skill.

The AI model only needs a portrait photo and a speech audio track. The output is ‘hyper-realistic’ and can capture a large range of expressive facial nuances, it said, with precise lip sync and natural head motions.

As an example, Microsoft provided a clip of Da Vinci’s Mona Lisa portrait singing a rap song.

Comparison with peers: Similar lip sync and head movement technology is available from AI company Runway, Nvidia’s Audio2Face AI application, Google’s Vlogger AI launched in March, and Emo AI by China’s Alibaba. “It (VASA-1) really beats everything else hands down,” said Pawan Prabhat, cofounder, Shorthills AI.

Deepfake concerns: As with any video-generating AI model, observers flagged that VASA-1 makes it easier to create deepfakes and that there is potential for misuse. “The thing we can hope for is that companies, especially Big Tech, put in the right guardrails and safety mechanisms before general availability,” said Jaspreet Bindra, founder, Tech Whisperer UK, a digital transformation and AI consulting firm.

Razorpay cofounders Harshil Mathur (left) and Shashank Kumar

Razorpay cofounders Harshil Mathur (left) and Shashank Kumar

Digital payments platform Razorpay on Tuesday launched its own Unified Payments Interface (UPI) infrastructure, or UPI Switch, in partnership with Airtel Payments Bank.

What does it do? The UPI Switch is designed to handle up to 10,000 transactions per second, at any given time, and enable five times faster access to UPI innovations for businesses. The company claimed that it resolves disputes seven times faster — within 24 hours against the industry average of seven days — as well as processes refunds instantly compared with the standard of up to three days.

Tell me more: The efficacy of UPI transactions relies heavily on the UPI infrastructure deployed by banks. These banks connect with the existing UPI infrastructure to facilitate seamless communication between the core banking systems and UPI technology during UPI transactions.

Razorpay said it had identified shortcomings in the current infrastructure, such as a lack of customisation features for businesses, resulting in scalability issues, technical declines and downtimes that hurt customer experience.

UPI momentum: In March, UPI transactions in India witnessed substantial growth, surging 55% in volume to 13.44 billion and over 40% in value to Rs 19.78 lakh crore compared with a year earlier.

Also read | Razorpay sees surge in credit card-linked UPI payments: report

Honasa Consumer’s cofounder and CEO Varun Alagh

Honasa Consumer’s cofounder and CEO Varun Alagh

Shares of Mamaearth parent Honasa Consumer rallied up to 7.6% to Rs 435 after the company announced that its skincare brand, The Derma Co, has achieved an annual revenue run rate of Rs 500 crore.

Investors cheer: Shares of Honasa have given 15.68% returns to investors in the last month, while the stock rallied 14% last week. The stock ended at Rs 338 on the BSE, up 8.51% from the previous day’s close.

Active ingredients-backed skincare brand The Derma Co achieved an annual revenue run rate of Rs 500 crore, driven by the creation of brands offering specialised products tailored for Indian skin and weather conditions, Honasa said on Monday. The company said it sold more than 10 million units under the brand in the last fiscal year.

Q3 recap: The company reported 265% growth in its consolidated net profit to Rs 26 crore for the quarter ended December, from Rs 7.1 crore a year earlier. Revenue from operations in the third quarter rose 28% year-on-year to Rs 488 crore.

Today’s ETtech Top 5 newsletter was curated by Megha Mishra and Ajay Rag in Mumbai.

Also in this letter:

■ ET Explainer: What is VASA-1?

■ Razorpay’s foray in UPI infrastructure

■ Mamaearth shares rally 8%

Office-sharing startup Awfis gets Sebi nod for IPO

Office-sharing startup Awfis Space Solutions has received Securities and Exchange Board of India’s clearance for an initial public offering (IPO).

IPO details: The Delhi-based company had filed its draft IPO papers in December, proposing to raise Rs 160 crore through an issue of fresh shares, along with a sale of 10 million shares by its existing shareholders.

The company plans to utilise the net proceeds from the fresh issue of shares for expansion and establishing new centres, working capital requirements and general corporate purposes.

Who’s selling: Peak XV Partners plans to sell about 5 million shares in Awfis through the proposed IPO. Bisque Ltd, a unit of private equity firm ChrysCapital, is also looking to sell nearly as many shares, while real estate investment trust Link Investment Trust is seeking to sell over 75,000 shares.

In its last fundraising round in 2022, Awfis was valued at around $110 million (Rs 917 crore at current exchange rates).

FY23 numbers: In the fiscal year ended March 31, 2023, Awfis’ operating revenue more than doubled to Rs 545 crore from Rs 257 crore in FY22, as per its draft red herring prospectus. For the first quarter of fiscal 2024, Awfis reported operating revenue of Rs 188 crore.

Upcoming IPOs: Several new-age companies, including SoftBank-backed Unicommerce, electric vehicle maker Ola Electric, omnichannel retailer FirstCry, and fintech firm Mobikwik have filed draft IPO papers with Sebi. Bengaluru-based food and grocery-delivery firm Swiggy is also planning to file soon for a $1 billion IPO.

Also read | WeWork to sell 27% stake in India unit via Rs 1,200 crore secondary deal

Investor group accuses Byju’s of violating NCLT order

The National Company Law Tribunal (NCLT), Bengaluru, on Tuesday heard the latest arguments in the Byju’s versus investors saga and adjourned the matter for hearing on June 6.

What happened today? The arguments began with a senior counsel on the investors’ side alleging a violation on the part of Byju’s with respect to an NCLT order dated February 27, which prevented the Bengaluru-based firm from allotting shares to investors as part of the disputed rights issue without procedurally increasing authorised share capital.

The tribunal had also directed Byju's to keep the proceeds from the $200 million rights issue in a separate escrow account. But Byju’s did not do this, and instead used the funds, the investors’ counsel alleged.

Byju’s stance: Byju’s counsel contended that its actions were performed in accordance with the law and did not violate the order as per its interpretation of the same.

A group of Byju’s investors led by Dutch investor Prosus is seeking to block a $200 million rights issue and the removal of founder Byju Raveendran as CEO of the edtech firm.

Zoom out: Byju’s, facing a severe cash crunch, paid only a part of March salaries to its employees, as of April 20, in yet another delay of these payouts. Earlier in the month, the startup laid off about 500 staffers, largely across sales and marketing functions.

Also read | Byju's seeks arbitration in dispute with investors; NCLT adjourns hearing to April 23

ET Explainer: What is VASA-1, Microsoft’s new ‘talking face’ generator?

Technology major Microsoft last week introduced a new image-to-video model called VASA-1 that it developed as a research project. Here’s a breakdown on what it’s all about:

What does the VASA-1 do? Microsoft described VASA-1 as an AI model that produces ‘lifelike audio-driven talking faces in real time’. ‘VAS’ stands for visual affective skill.

The AI model only needs a portrait photo and a speech audio track. The output is ‘hyper-realistic’ and can capture a large range of expressive facial nuances, it said, with precise lip sync and natural head motions.

As an example, Microsoft provided a clip of Da Vinci’s Mona Lisa portrait singing a rap song.

Comparison with peers: Similar lip sync and head movement technology is available from AI company Runway, Nvidia’s Audio2Face AI application, Google’s Vlogger AI launched in March, and Emo AI by China’s Alibaba. “It (VASA-1) really beats everything else hands down,” said Pawan Prabhat, cofounder, Shorthills AI.

Deepfake concerns: As with any video-generating AI model, observers flagged that VASA-1 makes it easier to create deepfakes and that there is potential for misuse. “The thing we can hope for is that companies, especially Big Tech, put in the right guardrails and safety mechanisms before general availability,” said Jaspreet Bindra, founder, Tech Whisperer UK, a digital transformation and AI consulting firm.

Razorpay forays into building UPI infrastructure, unveils ‘UPI Switch’

Digital payments platform Razorpay on Tuesday launched its own Unified Payments Interface (UPI) infrastructure, or UPI Switch, in partnership with Airtel Payments Bank.

What does it do? The UPI Switch is designed to handle up to 10,000 transactions per second, at any given time, and enable five times faster access to UPI innovations for businesses. The company claimed that it resolves disputes seven times faster — within 24 hours against the industry average of seven days — as well as processes refunds instantly compared with the standard of up to three days.

Tell me more: The efficacy of UPI transactions relies heavily on the UPI infrastructure deployed by banks. These banks connect with the existing UPI infrastructure to facilitate seamless communication between the core banking systems and UPI technology during UPI transactions.

Razorpay said it had identified shortcomings in the current infrastructure, such as a lack of customisation features for businesses, resulting in scalability issues, technical declines and downtimes that hurt customer experience.

UPI momentum: In March, UPI transactions in India witnessed substantial growth, surging 55% in volume to 13.44 billion and over 40% in value to Rs 19.78 lakh crore compared with a year earlier.

Also read | Razorpay sees surge in credit card-linked UPI payments: report

Honasa shares rally as The Derma Co hits Rs 500-crore revenue run rate

Shares of Mamaearth parent Honasa Consumer rallied up to 7.6% to Rs 435 after the company announced that its skincare brand, The Derma Co, has achieved an annual revenue run rate of Rs 500 crore.

Investors cheer: Shares of Honasa have given 15.68% returns to investors in the last month, while the stock rallied 14% last week. The stock ended at Rs 338 on the BSE, up 8.51% from the previous day’s close.

Active ingredients-backed skincare brand The Derma Co achieved an annual revenue run rate of Rs 500 crore, driven by the creation of brands offering specialised products tailored for Indian skin and weather conditions, Honasa said on Monday. The company said it sold more than 10 million units under the brand in the last fiscal year.

Q3 recap: The company reported 265% growth in its consolidated net profit to Rs 26 crore for the quarter ended December, from Rs 7.1 crore a year earlier. Revenue from operations in the third quarter rose 28% year-on-year to Rs 488 crore.

Today’s ETtech Top 5 newsletter was curated by Megha Mishra and Ajay Rag in Mumbai.

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Daily Top 5

We'll soon meet in your inbox.